Do you want to earn unlimited free airfare tickets every year and save money through cashback offers or discounts on food items? If yes, then IRCTC iMudra Card is for you. This card provides you benefits from several airlines and travel booking portals, and you can also redeem rewards with other partners such as Diners Club, American Express, etc. Read continue to know more about its use, feature, etc.

Let’s know briefly about the IRCTC iMudra card. The Indian Railway Catering & Tourism Corporation Ltd (IRCTC) has launched a new e-wallet called iMudra Card and two other cards named eCash and eDhan. These three cards provide various services and benefits to their holders. Some of these include earning points and cashback on purchases, having access to exclusive deals and offers across India and abroad, and train ticket booking using the IRCTC official website.

iMudra card has over 4 million enrolled members who are currently enjoying its benefits. Since the launch of this e-wallet, it has been gaining popularity day by day with added benefits and schemes. Many people are already paying their utility bills with an iMudra card.

What IRCTC iMudra Card actually is?

IRCTC (Indian Railway Catering & Tourism Corporation Ltd) introduced the iMudra card in October 2018, which is a prepaid card. In addition to offering certain discounts and benefits across various categories, it has also enabled booking tickets via mobile phones from within the application itself.

The iMudra card was introduced to provide instant cashless payment options through credit or debit cards at India’s railway stations and tourist destinations. This would eliminate the requirement of carrying change, thus aiding passengers who want to travel without lugging around heavy wallets.

With IRCTC iMudra, travellers now have access to a whole new world of possibilities. They can now go truly cashless. It’s an exciting time for Indian Railways.

What are the uses of IRCTC iMudra?

The uses of iMudra are limitless. IRCTC has given us true access to solve all payment trouble. Not only online mode, but you can also use the iMudra offline mode like on offline store, market, etc.

Some of the major use of IRCTC iMudra are:

1) For booking tour tickets (airway, railway, and roadway).

2) To send or receive money.

3) For payment of online and offline shopping

In short, iMudra is the only solution to go for hassle-free payment. Even you can use this card to withdraw cash from ATMs.

Also, for you: UMID Card: Indian Railways Unique Medical Identity Card Scheme

Why is iMudra different from other E-wallets?

Now it’s time to explore more about the iMudra wallet and know what its feature makes it different from other e-wallets.

Powerful features of IRCTC iMudra Wallet:

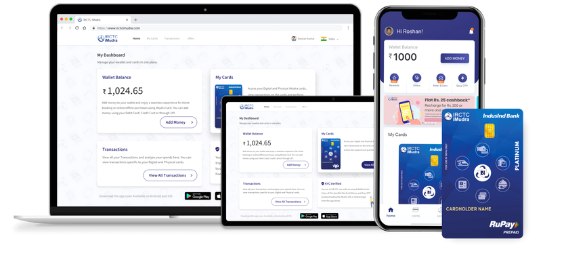

1) Accessible across all channel.

The iMudra wallet is a powerful software application that is meant to function seamlessly across all of your devices. The app works on all platforms, whether you have an Android, iPhone, or iPad. You also don’t have to be concerned because the app is also available for PC users. The iMudra app and official websites operate at the same speed and with the same efficiency on every platform.

2) Simple online or offline payment system.

The IRCTC mudra is available in both physical and virtual forms. You can now shop online, pay bills (mobile, electricity bill etc.), order meals on trains, book flights or train tickets, hotels, and movie tickets, and the list goes on. iMudra card allows you to withdraw cash from any bank ATM.

3) Simple to send and receive money.

You can use the IRCTC iMudra payment wallet to send and receive money to friends and family once you’ve completed the necessary KYC. So, if you need to pay a restaurant bill, a telephone recharge, tuition fees or college fees, iMudra can do these all. There is no longer any need to fill out forms to transfer money, and iMudra makes every payment simple with just one click. Now, you can transfer and receive money from IRCTC iMudra effortlessly and comfortably from home comfort.

4) Withdraw cash from any ATM

You can use your iMudra prepaid card to withdraw money. You can withdraw money from your wallet at thousands of VISA-enabled ATMs around the nation. So, if you have a refund in your wallet and want to cash it out, all you have to do is go to any ATM and swipe your IRCTC iMudra prepaid card. IRCTC Anyone can use an iMudra card for ATM transactions.

(Note: Before you can use the prepaid card to withdraw money, you must first complete your KYC (Know Your Customer) process.)

5) Special deals and offers

You can take advantage of iMudra’s special offers and discounts since it provides us with exclusive deals and offers from time to time. You can take advantage of such deals and save money on your online shopping.

6) Easy OTP option

Easy OTP is a six-digit one-time password that allows you to order railway tickets considerably more quickly than with conventional methods. All you have to do is go to your iMudra app and tab ‘Easy OTP’ and ‘Generate OTP,’ then keep it ready for an IRCTC ticket booking. Choose the iMudra option under ‘iPay’ to make your payment and input the generated OTP in the app during the ticket purchasing process.

Benefits of IRCTC iMudra wallet

The following are the advantages that IRCTC iMudra users enjoy:

1) Both free and safe Transactions.

2) Eliminates the payment approval cycle, which saves a significant amount of time during the ticket booking process.

3) The payment gateway charges no transaction fees.

4) Manage and top up your account from the comfort of your own home.

5) Send money instantly and simply from the e-wallet.

6) Less reliance on banks. You can simply book tickets using the iMudra wallet, even if there are some service difficulties.

7) Easy and save refund for your cancelled tickets.

How to Registered for IRCTC iMudra Wallet?

Here’s how to sign up for the IRCTC iMudra Wallet in a few simple steps.

1) Visit the iMudra website of the Indian Railway Catering & Tourism Corporation Ltd (IRCTC)

2) Tab on the “Login/Sign Up” button of the iMudra official page.

3) You will be redirected to the next page after clicking the “Login/Sign Up” button, where you will be requested to fill in your personal information such as first name, last name, date of birth, preferred name on the card, mobile phone number, e-mail ID, and so on.

4) Kindly fill up all the requested information correctly on the page.

5) Press on the “Get OTP” button at the bottom.

6) An OTP will be sent to the phone number you entered.

7) Submit the OTP you get on your registered mobile number and click “Verify”.

8) It will prompt you to update your KYC on the next page.

9) Choose any one option from the drop-down menu.

10) Fill in the number of the KYC document you’ve chosen.

11) Click the “Submit” button.

12) Your account will open after your KYC information has been updated.

13) Your KYC information is initially updated as “Minimum KYC,” but you must complete the full KYC to have full access and benefit from the card.

14) With the use of a PAN card and Aadhaar card authentication, a full KYC can be done shortly.

15) The minimum KYC card limit is ₹ 10,000 per month, whereas the full KYC card maximum is ₹ 100,000.

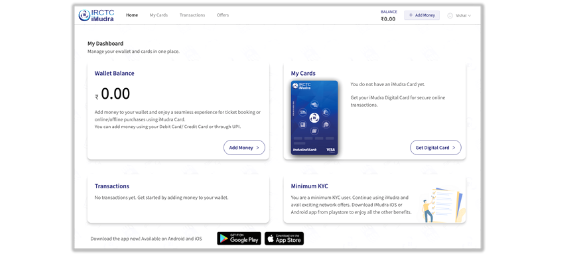

After that, you’ll be taken to the Dashboard, which looks like as below.

Go to your wallet balance and add money as required to add money to your wallet.

By selecting “Get Digital Card,” you can also obtain the iMudra card. When you click on the card, you’ll be prompted to choose which one you’d want to activate. Obtaining this card will cost you 59 INR (including GST).

Your digital card will be activated and shown on your dashboard after you have completed the payment for it. You will be given a one-of-a-kind card number that you can use for both digital and physical purchases throughout India. The only stipulation is that your account must have an adequate balance.

How to load money into IRCTC iMudra Wallet?

It’s simple to load money into the IRCTC iMudra VISA card. Any debit or credit card can be used to complete the transaction. Let me tell you how:

1) Hit the “Add Money” button from the drop-down menu.

2) Fill in the amount you’d like to deposit into your account.

3) Choose the method you wish to use to add funds to your card.

4) Enter the Security Pin Number of your card and move further to complete your “Add Money” process in your iMudra wallet.

IRCTC iMudra Card charges

There are no fees associated with opening an IRCTC iMudra wallet. However, if you choose a virtual or physical card, you will have to pay a fee.

Charges for the IRCTC’s iMudra physical card are as follows:

- ₹10 for a virtual card

- ₹200 + GST for a physical card

ATM transaction fees:

Federal Bank ATM transactions are free for the first three transactions per month. Any future transactions will incur a fixed fee of ₹23.6. A fixed cost of ₹23.6. would be applied to each transaction made with a non-federal bank.

Charges for adding money to the wallet:

Depending on the mode of payment, IRCTC levies a fee for adding money to the iMudra wallet. All users need to pay these charges based on the mode of payment.

Let’s see what certain charges we have to pay for adding money to the iMudra VISA card.

- 1.8 percent of the loaded amount on a credit card.

- NO charges for loads up to ₹ 2000 and 0.9% of loaded amount for loads beyond ₹ 2000 on a debit card.

- NO charges for loads up to ₹ 2000 and 0.65% of loaded amount for loads beyond ₹ 2000 on a UPI.

(Note: Use UPI to add funds to your IRCTC iMudra wallet since this method of payment is better because we only have to pay a very few amounts as a charge.)

Also, for you: Buy Food In Train

IRCTC iMudra Full KYC Process:

You won’t be able to use all of the functions of iMudra unless you’ve completed the IRCTC iMudra KYC. You won’t be able to use several important features and functionalities until you complete your KYC, such as withdrawing cash from an ATM, sending and receiving money, and so on. As a result, as soon as you access your iMudra wallet, you must complete your IRCTC iMudra full KYC. Take a look at how you can complete the IRCTC iMudra full KYC process.

You can complete the IRCTC iMudra KYC in two ways 1) Online and 2) Offline:

1) Online: Your Aadhaar number and the mobile number associated with your Aadhaar can be used to complete full KYC. You don’t need to provide any supporting documentation because this process is entirely online. Just Enter the correct Aadhaar number and some other asked details in the iMudra KYC section to get full features of iMudra.

Also, read: A simple & comprehensive guide to Indian Railways’ HRMS Login

How to do IRCTC iMudra Wallet full KYC online?

1) Go to the section of full KYC by clicking on it.

2) Enter your correct PAN number and upload a photo of your PAN card.

3) Enter the Aadhaar card number.

4) You’ll be prompted to snap a selfie and submit it to the app/portal

5) Your full KYC will be completed after this information is updated, and your account will be elevated to full KYC mode. This will raise your monthly wallet limit from ₹ 10000 to ₹ 100000.

2) Offline: An IRCTC iMudra representative will visit your location at a pre-arranged time to perform your full KYC. The iMudra agent will go over the physical copies of your supporting papers and update your KYC.

IRCTC iMudra full KYC verification requires the following documents:

- Xerox copy of your Aadhar ID.

- Your passport size photo.

- Your PAN card.

Main Benefits of IRCTC iMudra full KYC:

1) Minimum KYC users have a monthly wallet limit of ₹10,000, while complete KYC verified users have a maximum of ₹1,00,000

2) Users who have completed the full KYC process are able to withdraw cash from ATMs, whilst those who have completed the minimal KYC process are unable to do so.

3) Minimum KYC users cannot send or receive money online; however, full KYC users can send and receive money from other IRCTC iMudra customers at any time and from any location.

4) Users will have 12 months to complete their full KYC before their IRCTC iMudra wallet is deactivated.

Also, for you: Private Train In India: Full List Of Routes, Destinations & Timings

IRCTC iMudra Refer and Earn program

Do you know, you can get money by just suggesting the iMudra app to your near once. Yes, you have heard correctly. IRCTC has established the “iMudra Refer and Earn” scheme in order to improve the app’s popularity and user base. This programme allows you to earn up to ₹500. When your near one installs the application on your suggestion using your iMudra link, you can win up to ₹50 scratch cards. You must recommend the app to your friends and family, and if they join up using your link or referral ID, you will receive ₹50 in your wallet once they deposit at least ₹100.

Frequently Asked Questions on IRCTC iMudra.

Q: What is the IRCTC iMudra prepaid card?

A: The IRCTC iMudra prepaid card was introduced by Indian Railway Catering & Tourism Corporation Ltd (IRCTC) to provide an easy way for the user to pay for their Indian Railway ticket bookings, tatkal ticket booking, hotel booking, dining and any other purchase using debit cards, credit cards and net banking. In stores using visa-enabled machines, you can use the IRCTC iMudra wallet and prepaid card for counter transactions and online transactions too. iMudra card benefits are uncountable.

Q: Where can I use the IRCTC iMudra digital payment wallet?

A: You can use the iMudra wallet to pay for items at stores that accept Visa cards. You can use the IRCTC iMudra wallet to make online payments too. Aside from that, you can use your IRCTC prepaid card to make two free ATM transactions every month. You can also book train tickets using the IRCTC iMudra wallet.

Q: Can I use the IRCTC iMudra wallet to make online purchases on websites outside India?

A: Yes, you can use the iMudra wallet for making payments at any website or app that accepts Indian Rupees. You will need to register with the website/app and link your bank account to your iMudra wallet before using it. Indian websites accept Indian rupees; however, outside of India, just a few websites accept Indian currencies.

Q: What can you do with the iMudra App?

A: All of your transactions become smooth when you use the iMudra App. Whether you need to send money to another person or purchase a movie ticket, train ticket, flight ticket, dining or hotel reservation, everything is now easier with the iMudra App. Using the iMudra app for train booking is the most convenient way. Plus, you also get rewards for using iMudra.

Q: Is the IRCTC iMudra prepaid card free?

A: The iMudra prepaid card from the IRCTC is not free. The physical card costs ₹200 plus GST, with no card activation fees. You must also pay ₹10 for a virtual card that can be used for internet shopping and other activities.

Q: How safe is the IRCTC iMudra digital wallet?

A: IRCTC’s iMudra digital wallet, without disclosing card information, it’s safe and secure. It is the safest and most convenient option to go cashless in every transaction.

Q: Where can I use the IRCTC iMudra prepaid card?

A: IRCTC iMudra allows you to access your wallet from a mobile app, tablet, or desktop. A virtual and physical card is included in the iMudra digital wallet. The IRCTC iMudra card is a prepaid card that can be used to purchase things online or offline. However, you can use your imudra card to transact online by selecting Credit Card on the payment page.

Q: Can the IRCTC iMudra wallet help me get Tatkal tickets quickly?

A: Without a doubt! If you need Tatkal tickets immediately, you should use the IRCTC’s iMudra waller. When you purchase tickets with iMudra, you enjoy the following benefits:

1) Transaction failure rate is quite low.

2) Due to the absence of the payment approval cycle, the transaction was extremely quick. It’s really useful for Tatkal reservations.

3) There are no per-ticket payment gateway fees. There is just a flat fee of ten dollars, regardless of the size of the transaction.

4) Refunds are processed quickly.

Q: Is IRCTC iMudra prepaid card debit or a credit card?

A: Despite the fact that your iMudra wallet card is prepaid, you should use it to make online purchases and pick the Credit Card option.

Q: How to add money to the IRCTC iMudra wallet?

A: Simply select the “Add Money” option to add money to your IRCTC iMudra wallet. The amount must then be entered/selected, and your wallet must be loaded with a payment gateway such as a debit card, UPI, or credit card.

Q: Is there any charge for adding money to the IRCTC iMudra wallet?

A: Depending on the payment instrument, a certain convenience fee may be applied to the total amount that you put into your wallet.